What is a Housing Co-op?

A housing cooperative is a form of homeownership in which members own shares in a corporation that owns and manages the building they live in. The corporation owns the building, units, land and any common elements of the property, while each member owns a share of the corporation that gives them the right to vote on decisions about the building and the right to live in one unit in the building.

What is a Limited Equity Cooperative?

A Limited Equity Cooperative (LEC) is a type of housing co-op that is designed to be affordable to people with low and moderate incomes. Equity refers to the rights to ownership (ownership equity), financial interests (financial equity), and the co-op community (social equity) that housing co-op members have. In limited equity cooperatives, residents commit to gaining less financial equity when reselling their share in exchange for greater ownership and social equity while living in the co-op.

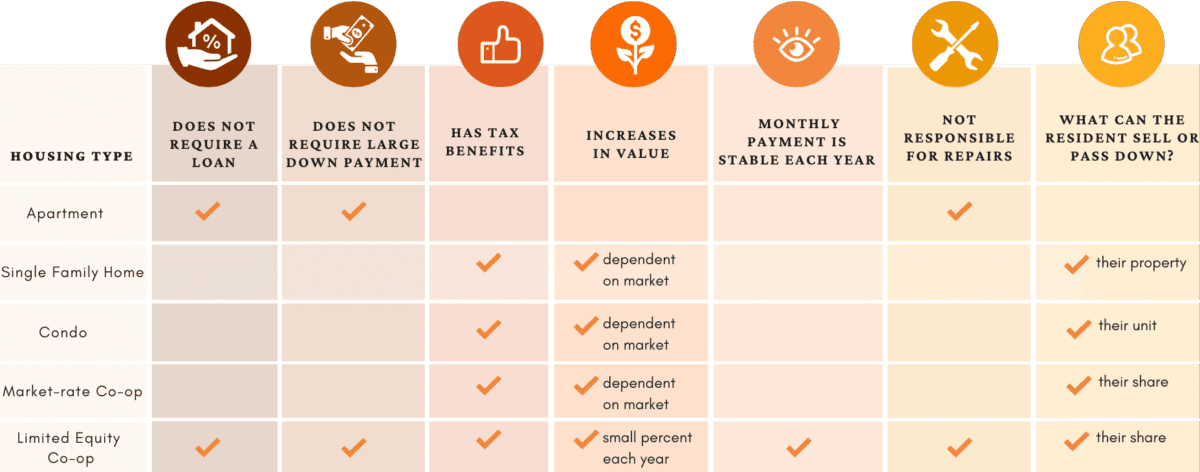

How is a Limited Equity Cooperative different from apartments, condos, market-rate co-ops, and single-family homes?

Limited equity cooperatives offer residents more community than other forms of homeownership. They offer more financial equity and control than apartments and are more affordable than condos and single family homes.

Limited Equity Co-ops are a More Effective Tool for Affordable Homeownership

Members of limited equity cooperatives receive tax deductions similar to those offered to single-family homeowners, and offer members a small amount of profit on the resale of their share. In addition to receiving tax benefits, people do not need to take out a loan or make a large down payment to purchase a membership share. This is possible because limited equity cooperatives limit the amount of profit residents can gain on resale of their share. Limiting the equity also makes the purchase price of a membership share much lower than the price of a market-rate co-op, condo, or single-family home.

Limited Equity Co-ops Offer More Stability

Unlike traditional single family homes, limited equity cooperative members are not responsible for repairs in their unit. The limited equity cooperative housing structure also limits motivation for drastic monthly charge increases ensuring that increases will be consistent with increases in operating costs. This increase in monthly expenses provides a sense of security and allows for members to stay in their homes for longer.

Limited Equity Cooperatives Give Residents More Control

As owners, cooperative members vote to select several of their neighbors to serve on the board of directors that makes decisions on how their building is managed. This gives members influence in the decision-making process on important choices about their building and the services that are available to them.

Limited Equity Cooperatives Build Stronger Communities

Cooperative living is based on the belief that communities are stronger together. Cooperatives may often include community gardens, community libraries, or may host community activities throughout the year that help build a sense of community among members.